Darryl Cotton of 151 Farmers discusses how legalization carries a host of concerns with it that may cause backsliding.

The following is an article produced by a contributing author. Growers Network does not endorse nor evaluate the claims of our contributors, nor do they influence our editorial process. We thank our contributors for their time and effort so we can continue our exclusive Growers Spotlight service.

The Devil is Always in the Details

Now that Cannabis is recreational and ‘legal’, I can go to my neighborhood dispensary and load up on legal weed, right? What else is there to worry about?

The truth is that there is plenty to worry about if you’re concerned about maintaining your civil liberties and you want to keep having access to the medical cannabis you’ve come to rely upon.

For the purposes of this article, we’re going to look at California’s Prop 64, the Adult Use of Marijuana Act (AUMA) and the subsequent passing of amendment SB 94, which combines medical and recreational cannabis with language that shows why the laws, rules and regulations will be of concern to anybody who consumes, produces, cultivates, or retails legal cannabis products. Your state’s rules may differ, but California is a good state to use as an example. Here’s why:

Legalization of cannabis means that environmental agencies will play an increasingly important role in determining who can cultivate and who can not.

Make no mistake about it, we're not saying that environmental protections are a bad thing. Rather, we are saying that cultivators and farmers need to be aware that new and existing governmental agencies will assume authority to change who can cultivate cannabis as well as how we do so.

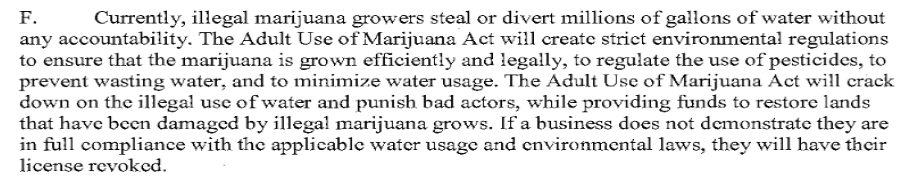

For example, in AUMA, the law specifically addresses water diversion and wastewater discharge issues. Within the language of this law, up to 13 different government agencies may revoke a cultivation license in order to defend the environment, as detailed within the AUMA language in SECTION 2 - FINDINGS and DECLARATIONS paragraph (F):

Here, the ‘Devil is Always in the Details’. No one would argue that making laws, rules and regulations that would prevent water diversion and waste water runoff from illegal cultivation sites would be a bad thing. Ensuring regulated usage of pesticides and minimizing water use while also punishing ‘bad actors’ are all good things voters can support.

The problem is in the verbiage. Within the same paragraph discussing illegal marijuana growers, is also included the line about “if a business does not demonstrate they are in full compliance with applicable water usage and environmental laws, they will have their license revoked.” This language ties both the illegal and the licensed cannabis farmer together in the same provision. This was not by accident. Nothing ever is.

How can any business person protect themselves from future changes? They can’t.

All a business person can do is make an informed decision with the best information and advice they have available to them at the time. If the advice they are receiving comes from respected sources such as attorneys, accountants, and industry leaders, then they are probably receiving sound advice.

But if the law is written in such a way that current wisdom can be overturned with rules or regulations that have yet to be written, would an informed business person elect to invest in that industry?

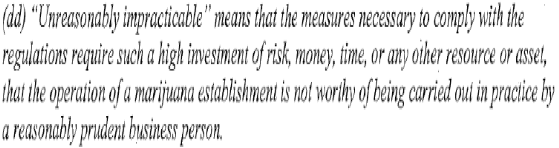

For example, within AUMA, Division 10, Chapter 1, General Provisions 26001(2)(dd), there is a warning to investors that if they choose to invest in our industry, the regulations and measures, many yet to be defined, may in fact make the entire endeavor “Unreasonably impractical”.

What attorney or financial advisor would ever advise their client to sign a contract where there was language warning them that they may be potentially entering into a contract unworthy of being carried out by a ‘reasonably prudent business person’? Has there ever been a law passed in any other industry whereby this type of language was included?

When a local government opens up regulated cannabis, citizens need to know that our elected officials have a well-developed vision for how cannabis will work in their community.

If I were a business person considering investing in your community’s cannabis industry, I would want the following questions to be answered:

- When passing city or country ordinances, what peer reviewed papers were used as the basis for determining the number of licensed dispensaries allowed?

- In regards to retail cannabis businesses, how will medical or recreational cannabis products will be made available to the public and how will they be taxed?

- Since licensed dispensaries will be the only form of retail distribution for cannabis products in your community, what economic model was used to determine the number of licensed cultivators necessary to meet the local demand?

- For example, if I were investing in a cultivation license in the City of San Diego, I would need to know how many cultivators (and/or square footage) would be necessary to be able to supply the 36 licensed dispensaries that will be opened within the city.

- If we continue this example, City of San Diego is licensing 40 cultivation sites. A regulatory commission must calculate both the low range of production for those cultivation sites as well as the high range and see if it fits the potential demand for products.

Now some might argue that the city is not in the business of restricting the square footage of the licenses for cultivation. I would say that is not true. By controlling the number of licenses available, cities could put themselves in a advantageous position over the industry. A city with heavy restrictions would raise the price of products until customers turn to alternative, unlicensed suppliers. Licensed cultivators, have to compete with both licensed and unlicensed cultivators in the city and from around the state. Severe restrictions in a city may give other cultivators the advantage of lower operating costs and thus a competitive advantage.

Let's do some math!

So how economical is Prop 64 in a given city? Let's take a look at San Diego.

- San Diego is licensing 36 retailer sites (dispensaries).

- The best industry averages estimate that cannabis retailers sell about 1 pound of cannabis per day, or 454 grams.

- If we assume that the retailer is open 365 days out of the year (x365), then on average they will sell nearly 165,710 grams per store per year.

- With 36 licensed stores (x36), that comes out to 5,965,560 grams of cannabis flower required for the local cannabis market per year.

So great! San Diego will probably need about 5.9-6.0 million grams of cannabis per year, or over 13,000 pounds. So how much cultivation space will we need to supply that demand? Let's do some more math!

- Statistical averages of cultivation estimate that cannabis flower yields are around 30-50 grams per square foot per harvest cycle, with an average of 4 harvests per year. So, on average, 120-200 grams per square foot per year.

- Now if we divide 5,965,560 grams of cannabis flower by this range, we arrive at some low-end and high-end estimates of cultivation space necessary to supply demand for the city:

- High-Yield Estimate (200 grams per square foot per year): 29,827 sq-ft of cultivation space.

- Low-Yield Estimate (120 grams per square foot per year): 49,713 sq-ft of cultivation space.

But wait! San Diego also licenses the number cultivation sites. So the square footage we provided above needs to be further divided by the number of licenses that San Diego anticipates it will need:

- San Diego is licensing 40 cultivation sites.

- Let's use the ranges we established above, and divide by 40!

- High-Yield Estimate: 29,827 ÷ 40 = 745 square feet per cultivation license to feed local demand.

- Low-Yield Estimate: 49,713 ÷ 40 = 1,242 square feet per cultivation license to feed local demand.

That's not a lot of space needed. While dispensaries can raise prices to deal with taxes or mandatory fees, cultivators' hands are tied by what dispensaries are willing to pay and how other cultivators can undercut them. Per AUMA Section 7, Paragraph 34012(a)(1), cultivators will be taxed by the State on that flower at a rate of $9.25 per dry weight ounce and on the leaves at a rate of $2.75 per dry weight ounce before it can leave the farm.

In short, in this described scenario... it would be a bad business decision to be a cultivator in most circumstances. As business people who consider themselves to be ‘reasonably practicable’ we’d really like local governments to tell us what the total square footage of cultivation licensing is going to be in your city, how much of that will be used for medical and how much will be used for recreational and how many dispensaries is that expected to serve?

Or, as the saying goes... the devil is in the details.

10 Best Gift Ideas for Cannabis Connoisseurs and Growing Aficionados (2022)

December 7, 2022Developing and Optimizing a Cannabis Cultivation System

December 14, 2021Dealing with Insomnia: How Can CBD Help?

December 10, 2020Your Guide to Sleep and CBD

December 7, 2020

Do you want to receive the next Grower's Spotlight as soon as it's available? Sign up below!

Resources:

- Want to learn more about subjects similar to those touched upon in this article? Check out our articles on subjects such as:

- Want to get in touch with 151 Farmers or Darryl? They can be reached via the following methods:

- Website: http://151farmers.org/

- Email: info@151Farmers.org