This report from Headset.io examines who’s buying cannabis, how much they’re buying, and other interesting nuances to purchasing decisions. Take a look!

The following is an article produced by a contributing author. Growers Network does not endorse nor evaluate the claims of our contributors, nor do they influence our editorial process. We thank our contributors for their time and effort so we can continue our exclusive Growers Spotlight service.

Disclaimer

This article was first produced by Headset.io. You may read the original article here.

Introduction

It’s no secret that people are buying legal cannabis at unprecedented rates these days. Sales numbers grow year after year, and reports project that the cannabis market will top $20 billion in just a few years.

For this report, Headset used demographic data from customers who voluntarily signed up for their rewards programs in Washington State to look at everything from brand preference to price sensitivity across the generational spectrums.

Are you might expect, cannabis is most popular with Millennials, who grew up in a world with much more relaxed views on the plant. However, Gen X’ers consume nearly as much cannabis as Millenials, and Baby Boomers are a significant part of the consumer base as well. While older generations consume in fewer numbers than Millennials, they have more money to spend. Data for Generation Z — those born in the mid-90s to mid-2000s — is minimal, as only a tiny fraction of them are of legal age. However, they will be an important demographic to keep an eye on in the future.

Anyone seeking insights into what Gen X’ers or Millennials are looking for will find this report useful. However, this report also offers interesting observations as to each generation’s preferences and values, and how those reflect in their purchasing habits. Designing specials and promotions based on those habits will be a key part of marketing success as the industry broadens and welcomes a new, more age-diverse customer base.

Methodology

Data for this report comes from real-time sales reporting by participating Washington State retailers via their POS systems, which are linked with Headset’s business analytics software. This report uses data collected in the state of Washington from September 2017, cross-referenced with Headset’s catalog of over 150,000 products, providing detailed information on market trends.

Headset’s data comes digitally direct from its partner retailers. However, there is a potential for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there may be a slight margin of error to consider.

Demographics

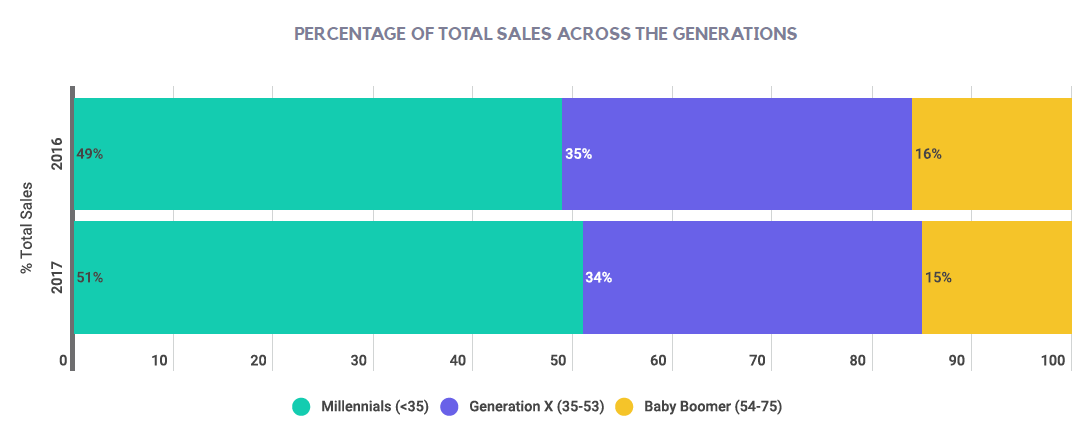

Millennials have dominated the market since we began looking at the data, holding 49% of the total market share in 2016, with a slight increase to 51% in 2017.

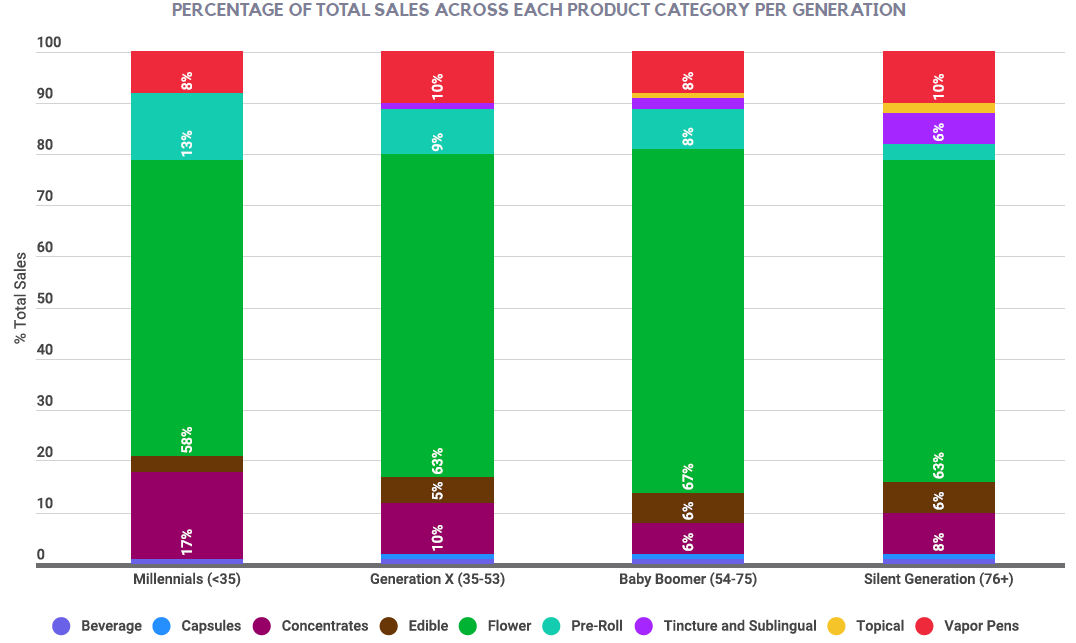

Flower continues to remain the largest overall sales category, regardless of generation. What is interesting though, is that the second place category is different for each generation. For Millennials, Concentrates were second place at 17% of their sales. For Gen X’ers, second place was a tie between Concentrates and Vapor Pens. Boomers like Vapor Pens and Pre Rolls, while the Silent Generation goes for just Vapor Pens. In terms of consumption of flower by volume, Millennials, Generation X, and Baby Boomers all split their spend in a remarkably similar way.

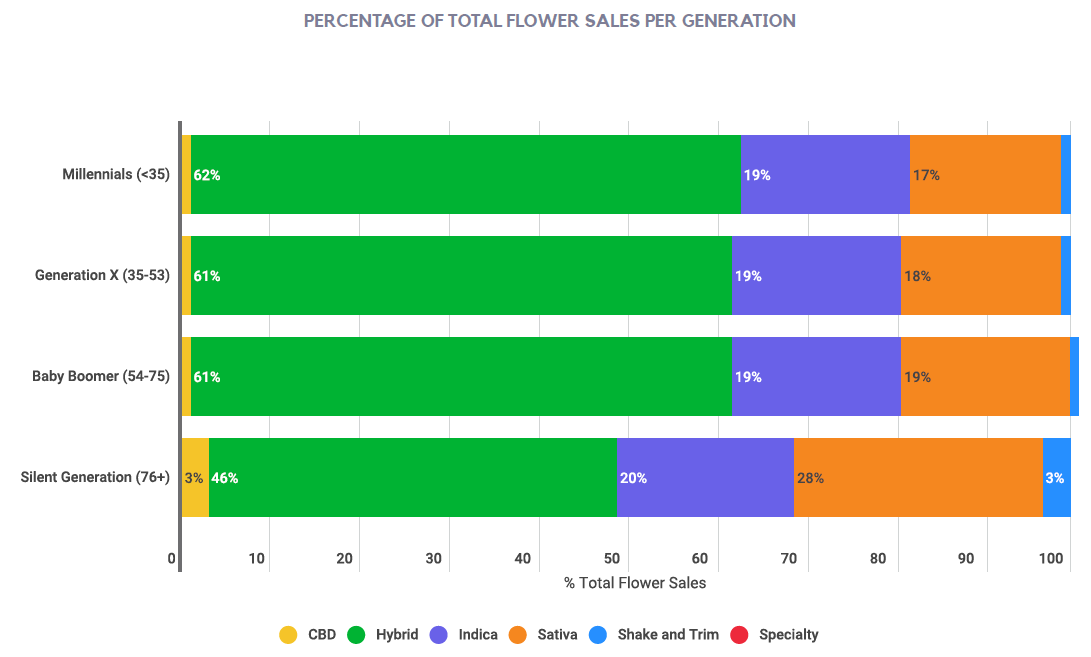

Within flower, all generations preferred hybrid strains by a significant margin, as shown in the chart below. The Silent Generation is slightly different because they prefer a little less hybrid and a little more straight indica or straight sativa, but the breakdown is otherwise identical for the other generations.

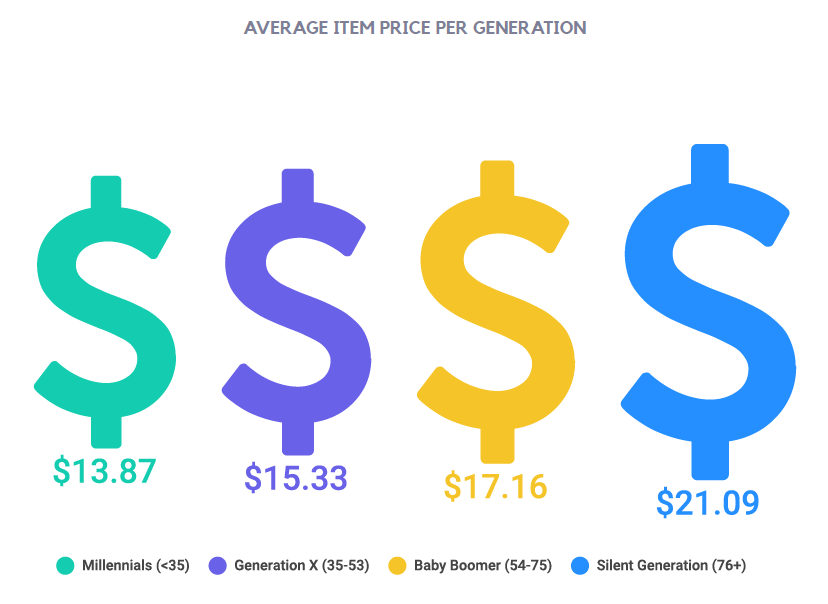

As might be expected, given the much-publicized economic woes facing Millenials, average basket size is smaller the younger the consumer is. The average item price (AIP) in a Millennial’s basket is only about $14, while AIP is about $17 for Boomers, and even higher in older generations.

Over half of the items purchased by Millenials were under $10, corroborating the AIP data from above. Gen X made just under half of its purchases below $10, while Boomers and the Silent Generation made the most pricey purchases. The Silent Generation purchased nearly 10% of its items at over $40. Can’t take it with you when you go, right?

Editor’s Note: This bodes well for companies trying to sell premium cannabis brands: Target your marketing towards older demographics.

Want to read the rest?

Check out the rest of the report on Headset.io’s blog! It is free to download and read.

10 Best Gift Ideas for Cannabis Connoisseurs and Growing Aficionados (2022)

December 7, 2022Developing and Optimizing a Cannabis Cultivation System

December 14, 2021Dealing with Insomnia: How Can CBD Help?

December 10, 2020Your Guide to Sleep and CBD

December 7, 2020

Do you want to receive the next Grower's Spotlight as soon as it's available? Sign up below!

Resources:

- Website: https://www.headset.io/

- Email: sales@headset.io

Do you have any questions or comments?

About the Author

Headset is market data and business intelligence for the cannabis industry. Our extensive Industry Report deep-dives into specific brands to help businesses better monitor the competitive landscape and perform exhaustive category analysis. Reports are generated via aggregate, real-time transaction data to get a unique and thorough analysis of what’s happening in the Washington market and other states as the data becomes available.