In this Growers Spotlight, we spoke with Jeff Blankinship and Elizabeth Becker of Cannabis Captive Insurance about how a captive insurance model may be well-suited to fit the needs of the cannabis industry and its unique challenges.

The following is an interview with industry experts. Growers Network does not endorse nor evaluate the claims of our interviewees, nor do they influence our editorial process. We thank our interviewees for their time and effort so we can continue our exclusive Growers Spotlight service.

To skip to any section within this article, click the links below:

Abbreviated Article

Editor's Note: Growers Network appreciates its readers! If you are limited on time, we are now offering abbreviated versions of our articles. Click below to view.

Risk Mitigation

What’s the difference between captive insurance and regular insurance?

- Not many people know about it.

- It generally isn’t worth setting one up for coverage less than half a million dollars.

Why would you want a captive insurance program over a normal insurance company?

- Risk Mitigation

- Asset Protection

- Wealth Accumulation

What are the limits of a captive insurance program?

Asset Protection

What are the pros and cons of a captive insurance company?

- You control and own the insurance company.

- You can cover events that might not be otherwise coverable.

- Your assets are protected.

- Insurance companies pay capital gains taxes, rather than ordinary income taxes.

- There is more administrative and legal work to operate the captive.

- Captives are not short-term propositions. Most people generally establish captives with the intent of using them at least 5 years.

What is preventing this system from abuse?

What about a group captive?

How do you start a captive insurance company?

If you like the abbreviated article, let us know in the survey at the bottom of the article! We're always interested in hearing your feedback.

If you want to read more, you can read the full article below.

Risk Mitigation

- Not many people know about it.

- It generally isn’t worth setting one up for coverage less than half a million dollars.

- Risk Mitigation

- Asset Protection

- Wealth Accumulation

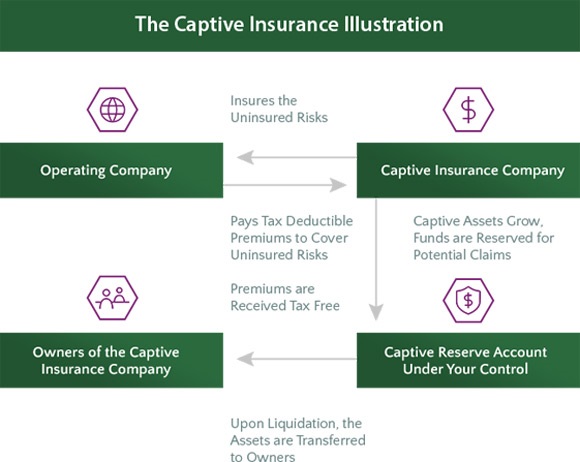

A diagram demonstrating how captive insurance works.

A diagram demonstrating how captive insurance works. Where do you domicile?

Where do you domicile?Asset Protection

- You control and own the insurance company.

- You can cover events that might not be otherwise coverable.

- Your assets are protected.

- Insurance companies pay capital gains taxes, rather than ordinary income taxes.

- Your pool of “riskholders” is much smaller, and significant claims against your policy can result in a bankruptcy of the captive. Captives are best used as supplementals to your primary policies.

- There is paperwork and legal work that must be resolved in order to set up the captive.

- As I said before, I wouldn’t create a captive for less than $600,000 of premium for this reason.

- You must domicile in the place that you would like to set up your captive insurance program.

- The premium you pay must remain liquid for the period of the policy, or you will be breaking federal law.

- If you want to establish a coverage in the event of a lawsuit (IE Malpractice for doctors), you could end up on the hook for significantly more money than you might have to pay with an ordinary insurance policy.

- Captives are not short-term propositions. Most people generally establish captives with the intent of using them at least 5 years, if not longer.

The IRS finds this stuff exciting.

The IRS finds this stuff exciting.- Your revenue.

- The coverages and policies you want.

Wealth Accumulation

About Cannabis Captive Insurance

- Any business that touches the plant is unable to use an FDIC-insured bank due to federal prohibition.

- The insurance market in cannabis is relatively limited and rarely covers cannabis-specific problems.

- Section 280e of the IRS tax code prohibits any business involved in the production, distribution, or sale of federally-prohibited substances (aka Cannabis) from taking tax deductions or tax credits on their tax returns.

10 Best Gift Ideas for Cannabis Connoisseurs and Growing Aficionados (2022)

December 7, 2022Developing and Optimizing a Cannabis Cultivation System

December 14, 2021Dealing with Insomnia: How Can CBD Help?

December 10, 2020Your Guide to Sleep and CBD

December 7, 2020

Do you want to receive the next Grower's Spotlight as soon as it's available? Sign up below!

Want to get in touch with Cannabis Captive Insurance?

You can reach them via the following methods:

- Website: http://www.cannabiscaptiveinsurance.com/

- Phone: 833-322-7848

Do you have any questions or comments?

About the Author

Hunter Wilson is a community builder with Growers Network. He graduated from the University of Arizona in 2011 with a Masters in Teaching and in 2007 with a Bachelors in Biology.