This report from Headset.io is a deep dive into the effects of geographic location on a store’s sales. To get an idea of how tastes and preferences change as you move from the city out to the country, Headset broke stores down into urban, suburban, and rural areas.

The following is an article produced by a contributing author. Growers Network does not endorse nor evaluate the claims of our contributors, nor do they influence our editorial process. We thank our contributors for their time and effort so we can continue our exclusive Growers Spotlight service.

Disclaimer

This article was first produced by Headset.io. You may read the original article here.

Introduction

We used a mix of subjective and objective criteria to delineate between the three categories of urban, suburban, and rural. We generally classified areas as suburban that were directly next to large urban centers regardless of the overall population of those areas. For example, a store in Renton, which abuts Seattle, would be suburban and one in Spokane would be urban, even though Renton’s population in 2016 was over 100,000, nearly half of Spokane’s 216,000.

Once we sorted out the state’s cities that had reported active sales in 2016 and 2017, we dove deeper into the ways in which the zones differed, such as the average item price to the popularity of edibles. Turns out, city slickers have the biggest appetite for brownies.

Beyond these specific breakdowns, this report provides broader insight into the ways location affects growth and sales for cannabis retailers. We believe this report will be invaluable for retailers across the country, as well as the producers and processors that sell to them. Except in cases of regional bans or moratoria on cannabis businesses, consumers don’t travel far for their pot, and thus knowing the local market is essential.

Methodology

Data for this report comes from real-time sales reports by participating Washington State cannabis retailers via their point-of-sale systems, which are connected to Headset’s business analytics software. This report is based on data collected in the state of Washington from November 2016 to 2017. That data is cross-referenced with Headset’s catalog of over 150,000 products to provide detailed information on market trends.

This information comes directly from our partner retailers. However, there is a small potential for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider.

Where Are the Stores? How Are They Doing?

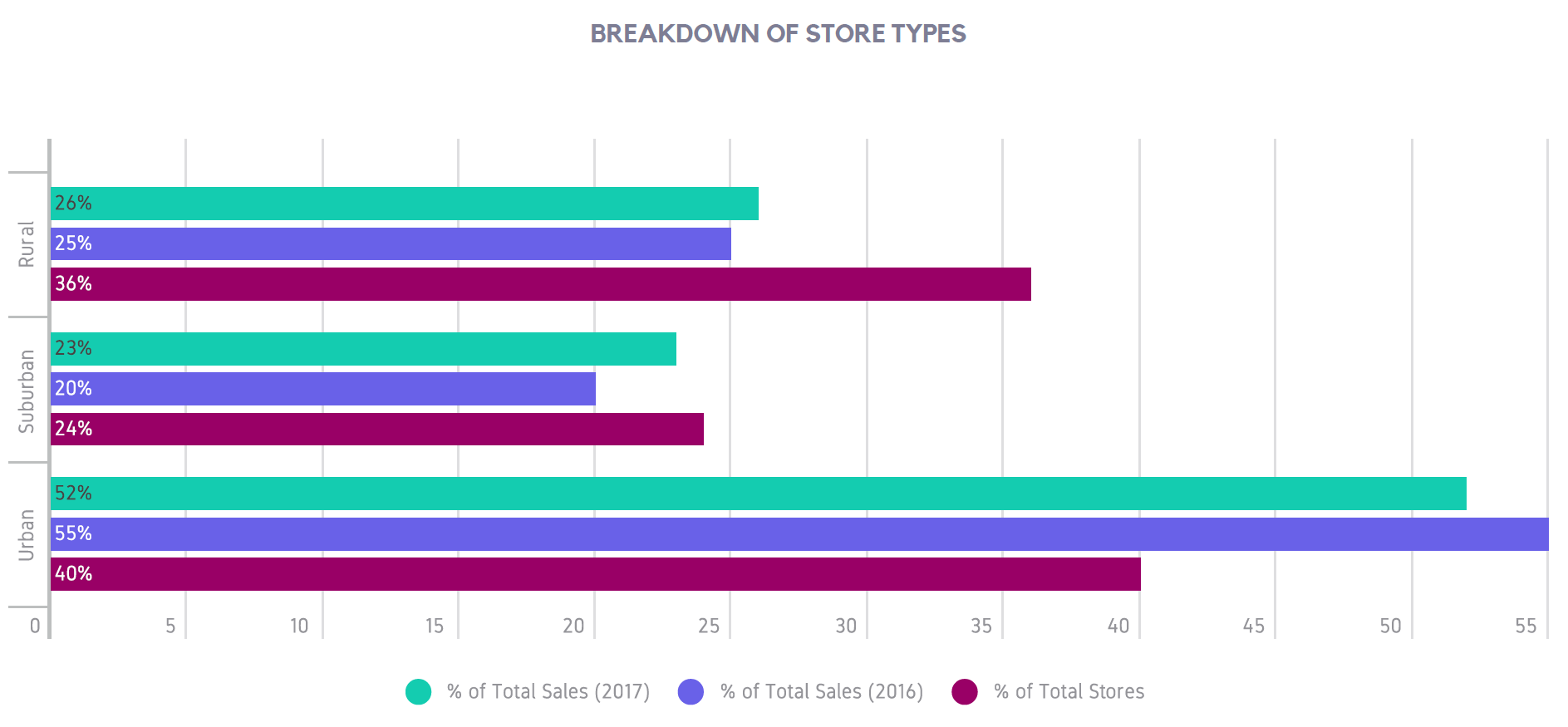

Of the stores that met the criteria for this dataset, 40% were Urban, with Suburban and Rural stores coming in at 24% and 36%, respectively. Though they remain the largest grouping of stores, total sales for urban stores dropped slightly between 2016 to 2017, with -11% growth. Rural stores also dropped 4%, while suburban stores grew 6%.

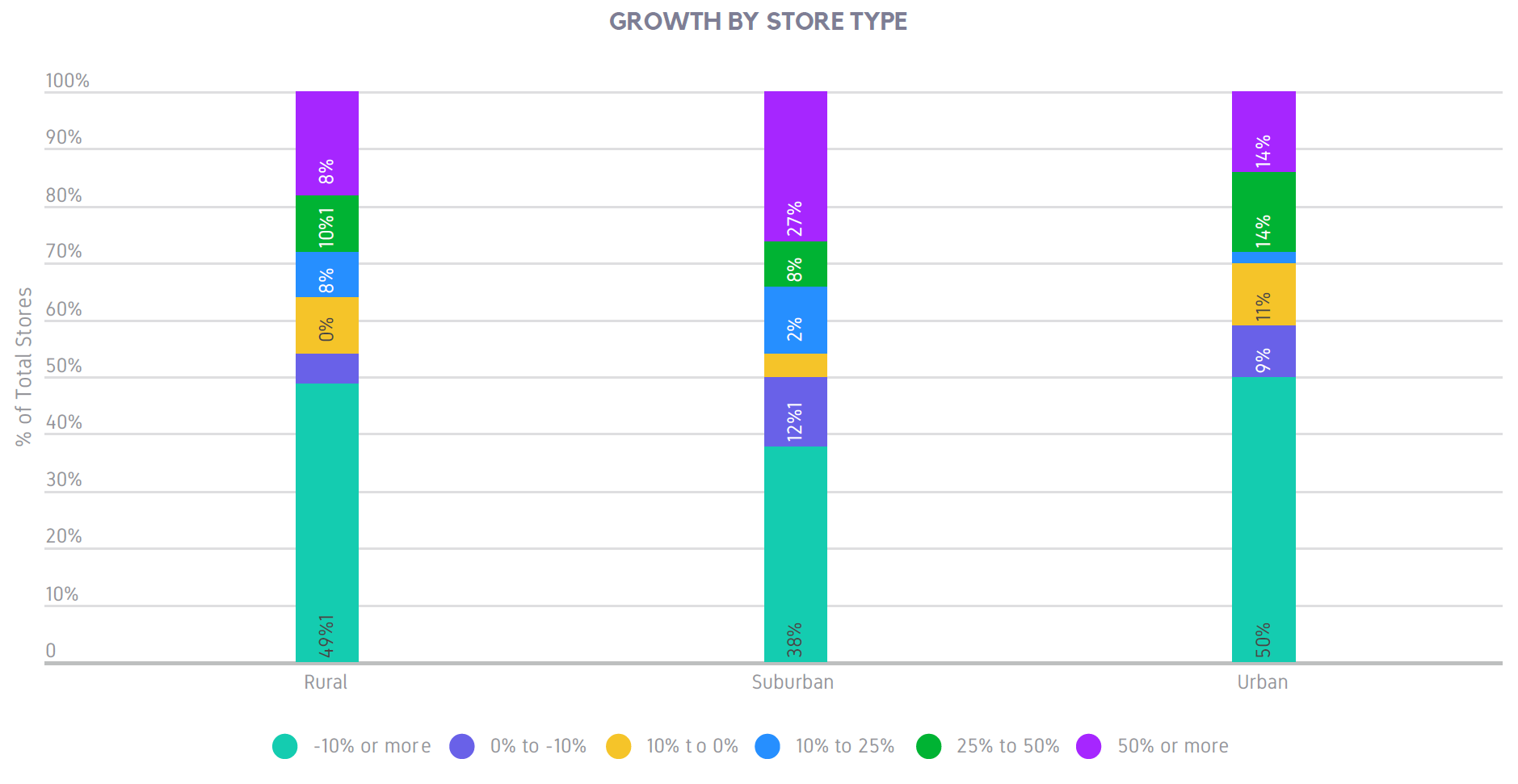

The majority of urban stores have seen negative growth with 59% seeing sales growth below 0% since 2016. This is compared to 54% in rural stores and 50% in suburban stores. Suburban and rural stores also see a larger portion of the stores with a growth rate over 50%.

Editor’s Note: Investors, take note of these facts. There is a wide variation in growth for any given location.

Want to read the sections we've snipped out?

Head on over to Headset's article and sign up for a demo!

Conclusion

The data here shows that consumers do have distinct preferences based on their geographic region. While suburban consumers are unsurprisingly similar to urban ones, real differences emerge when you look at rural stores.

Rural consumers seem to be less interested in trying new or alternative consumption methods, as evidenced by their strong preference for traditional flower, lack of affinity for edibles, and an overall lower number of products in stores. The wide differences in category-specific AIP from rural to urban zones for the concentrate and topical categories, with rural prices much lower than urban, speaks to this as well. Thus, anyone looking to introduce something a little more offbeat would be wise to visit their accounts in the city first.

However, rural stores also have more potential to grow, and are indeed the only stores currently doing so. This could indicate that sales in urban and suburban areas are approaching or have even arrived at a plateau, and that new products actually have a better chance at taking hold in rural stores. It will be interesting to see if this growth trend continues along the same geographic lines into 2018!

10 Best Gift Ideas for Cannabis Connoisseurs and Growing Aficionados (2022)

December 7, 2022Developing and Optimizing a Cannabis Cultivation System

December 14, 2021Dealing with Insomnia: How Can CBD Help?

December 10, 2020Your Guide to Sleep and CBD

December 7, 2020

Do you want to receive the next Grower's Spotlight as soon as it's available? Sign up below!

Resources:

Want to get in touch with Headset.io? They can be reached via the following methods:

- Website: https://www.headset.io/

- Email: sales@headset.io

Do you have any questions or comments?

About the Author

Headset is market data and business intelligence for the cannabis industry. Our extensive Industry Report deep-dives into specific brands to help businesses better monitor the competitive landscape and perform exhaustive category analysis. Reports are generated via aggregate, real-time transaction data to get a unique and thorough analysis of what’s happening in the Washington market and other states as the data becomes available.